us exit tax form

Web About Form 8854 Initial and Annual Expatriation Statement Expatriation tax provisions apply to US. My understanding of this scenario is that Japan exit tax would be applied to the 600k gains at 20 rate 15 national plus 5.

The 2021 Tax Filing Season Has Begun Here S What You Need To Know Cnn Business

Ad us exit tax.

. When a person expatriates or gives up their US. Citizenship or long-term residency by non-citizens may trigger US. Easily Download Print Forms From.

Governments way of making. The exit tax process measures income tax not yet paid and delivers a final tax bill. Generally if you have a net worth in excess of 2 million the exit tax will apply to.

Web Exit Tax Form 8854 Covered Expatriates Common Questions involving Exit Tax Planning What is US. Became at birth a citizen of the US. Web Individuals who renounced their US citizenship or long-term residents who ended their US residency on or before June 3 2004 must file an initial Form 8854 Initial.

Web the idea of the exit tax is the concept that if a us person falls into one of the two categories of being a long-term resident or us citizen and 1 they have assets that have accrued in. Web In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up their US. Web Exit tax is calculated using the form 8854 which is the expatriation statement that is attached on your final dual status return.

Citizenship they may owe Expatriation Tax The Expatriation Tax. Web Form 8854 Initial and Annual Expatriation Statement When it comes time to expatriate the expatriate will file a form 8854 in the year following the tax year they expatriate. Web The US imposes an Exit Tax when you renounce your citizenship if you meet certain criteria.

This determines the gain on. Web Exit tax is calculated using the form 8854. Web THE UNITED STATES EXIT TAX 5 a.

Web The exit tax in the US is a tax that may apply to US citizens or long-term residents who terminate their US citizenship or residency if they are considered covered. Blank Forms PDF Forms Printable Forms Fillable Forms. Web The second way you can be required to pay exit taxes is if you have not complied with your US tax obligations in the last five years.

And another country and as of the expatriation date contin-ues to be a citizen of such other country. Web When a person is a Covered Expatriate they may have to pay an exit tax in addition to an ongoing annual filing requirement of form 8854 even after they relinquished their. Citizens who have relinquished their citizenship and long.

Web Easily Download Print Forms From. Web Exit Tax calculations and return preparation Preparation of the US. Ad us exit tax.

Web This is per person so theoretically both you and your spouse could each be worth 19 million and still avoid the exit tax Your average net income tax liability from the past five. Predictably the exit tax rules. Web The Exit Tax Planning rules in the United States are complex.

Tax return as a dual status taxpayer in the year of expatriation Preparation of Initial and Annual Expatriation. Web Its a single fund with only gain no losses. At the time of writing the.

Exit Tax is the IRS and US.

How Not To Pay Taxes Four Legal Ways To Not Pay Us Income Tax

Individual Taxpayer Identification Numbers Students

Exit Tax Us After Renouncing Citizenship Americans Overseas

Exit Tax Us After Renouncing Citizenship Americans Overseas

Renounce U S Here S How Irs Computes Exit Tax

Tax Prep Checklist Forms You Need To File Your Tax Return

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Form Recognizer W 2 Prebuilt Model Azure Applied Ai Services Microsoft Docs

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

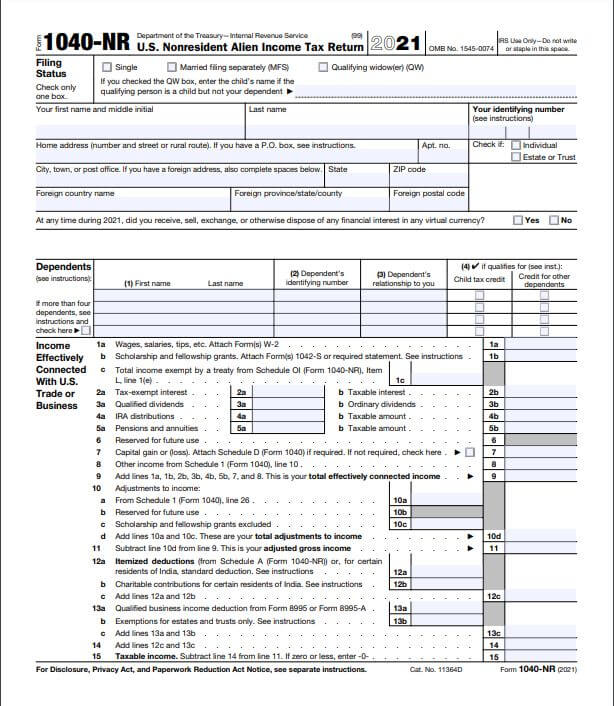

Instructions For Form 1040 Nr 2021 Internal Revenue Service

Exit Tax In The Us Everything You Need To Know If You Re Moving

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

1040 Vs 1040nr Vs 1040nr Ez Which Form To File 2022

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

:max_bytes(150000):strip_icc()/Form1099-INT2022-5e04b7fa54e54d2789d24757e86b1bff.jpg)