osceola county property taxes due

2505 E Irlo Bronson Memorial Highway. Oceola Township current property taxes are able to be accessed and paid online using debitcredit cards.

If Osceola County property taxes are too high for your revenue resulting in delinquent property tax.

. You can report a playback problem to the Osceola County IT Department using one of the methods below. Welcome to the Tax Online Payment Service. Collects Property Tax Payments.

And remember if you mail your payment it MUST BE postmarked on or before October 2nd to avoid a penalty. OSCEOLA COUNTY TAX COLLECTOR. The 2021 Winter Tax bills were mailed Wednesday December 1st 2021.

Search all services we offer. You may contact their offices at 517-546-7010. Irlo Bronson Memorial Hwy.

Just a reminder that we will be closed Monday May 30 2021 in observance of Memorial Day and will reopen on Tuesday May 31 2021 at 8 am. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. The first payment was due in the fall of the year with the last payment due the following spring.

A valid deferment permits summer property taxes to be paid on or before February 14th without any additional penalty and interest. The statistics from this question refer to the total amount of all real estate taxes on the entire property land and buildings payable to all taxing jurisdictions including special assessments school taxes county taxes and so forth. Taxpayers may defer their summer property tax if they meet the following.

Summer taxes are due by September 14 without interest. The County Treasurers Offices in the four-county area are open Monday through Friday from 8 am. Visit their website for more information.

Tangible personal property tax is an ad valorem tax assessed against the furniture fixtures and equipment located in businesses and rental property. Motor Vehicle Titles and Registrations. Taxes can be paid online in person or by mail.

All unpaid taxes are delinquent on March 1st of this year and forwarded to the Livingston County treasurer for collection. Property taxes are due on September 1. If you dont pay by the due date you will be charged a penalty and interest.

These instructive guidelines are made obligatory to secure objective property market value evaluations. When are taxes due. 407-742-3995 Driver License Tag FAX.

TREASURERS OFFICE WILL BE CLOSED 1230 - 130 FRIDAY MAY 20 2022. With market values established Osceola along with other in-county public bodies will calculate tax rates independently. Registration and renewal of trucks over 5000 pounds truck tractors semi-trailers buses or vans carrying nine-passengers or more for hire due by December 31st.

Enjoy online payment options for your convenience. Osceola County has one of the highest median property taxes in the United States and is ranked 516th of the 3143 counties in order of median property taxes. Or before the date your summer taxes are due whichever is later.

BSA Software provides BSA Online as a way for municipalities to display information online and is not. Ad Find Out the Market Value of Any Property and Past Sale Prices. Osceola County Property Appraiser.

Economic Development Commission 300 7th Street Sibley Iowa 51249 712 754-2523. What is the due date for paying property taxes in Osceola county. If you would like to pay when we are closed or prefer not to come inside we have a walk-up secured drop.

Residents Happy Memorial Day from all of us at the Property Appraisers office. To Pay Taxes Online. See on back for code description See on back for code description JOHN DOE 123 MAIN ST KISSIMMEE FL 34741 COUNTY OF OSCEOLA MSTU.

The following data sample includes all owner-occupied housing units in Osceola Indiana. Florida nor the Tax Collector for Osceola County. Third property tax installment program payment due December 31st.

If you go to your Treasurers Office or if you mail your tax payment be the proper stub accompanies your payment. Osceola County Courthouse 300 7th Street Sibley Iowa 51249 712 754-2241. Osceola County Treasurer 301 W Upton Ave Reed City MI 49677.

Osceola County collects on average 095 of a propertys assessed fair market value as property tax. All personal property taxes are payable to the Village of Osceola and due by January 31st of each year. Due to this bulk appraisal method its not only probable but also inescapable that some market value evaluations are incorrect.

Payment of the balance due along with the recording fee and state documentary stamps of 070 per 10000 of the high bid must be paid within 24 hours from the time of the winning auction. If you have a mortgage your property taxes are probably paid by your lender through an escrow account. All taxes become delinquent to the County Treasurer on March 1 with additional penalties and interest.

Osceola NOTICE TO TAX SALE PURCHASERS 2022. The final 2021-2022 payment is now due if you havent already paid it. We remember and honor those who served and sacrificed.

These taxes are due Monday February 28 2022 by 500pm. When added together the property tax burden all taxpayers support is created. The Tax Collectors Office provides the following services.

Please utilize our website whenever possible. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email. This service allows you to make a tax bill payment for a specific property within your Municipality.

Pay Property taxes in Osceola County Florida with this online service. The purpose of the sale of tax deeds is to satisfy delinquent property taxes. OSCEOLA COUNTY TAX COLLECTOR.

Pay Property Taxes Online in Osceola County Michigan using this service. Winter taxes are due by February 14 without penalty. The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200.

After 500pm After this time all unpaid taxes will be sent as delinquent to the Livingston County Treasurer. To begin please enter the appropriate information in one of the searches below. As part of our commitment to provide citizens with efficient convenient service the Village has partnered with Official Payment Corporation to offer payment of your personal property taxes over the internet or by telephone by calling 1-800.

Welcome to Osceola County Iowa. New Drivers Licenses. Osceola County Treasurer.

And the taxpayer will be required to pay the taxes due in full by March 31st. Live Chat Available Mon-Fri 800AM-600PM Call 407-742-2900 to. In this basic budgetary function county and.

Osceola Tax Collector Website.

Osceola County Tax Collector S Office Bruce Vickers

Osceola County Fl Property Tax Search And Records Propertyshark

Osceola County Tax Collector S Office Bruce Vickers

Property Tax Search Taxsys Osceola County Tax Collector

![]()

Osceola County St Cloud Propose Smaller 2021 22 Budgets Osceola News Gazette

Osceola County Tax Collector S Office Bruce Vickers

Osceola County Tax Collector S Office Bruce Vickers

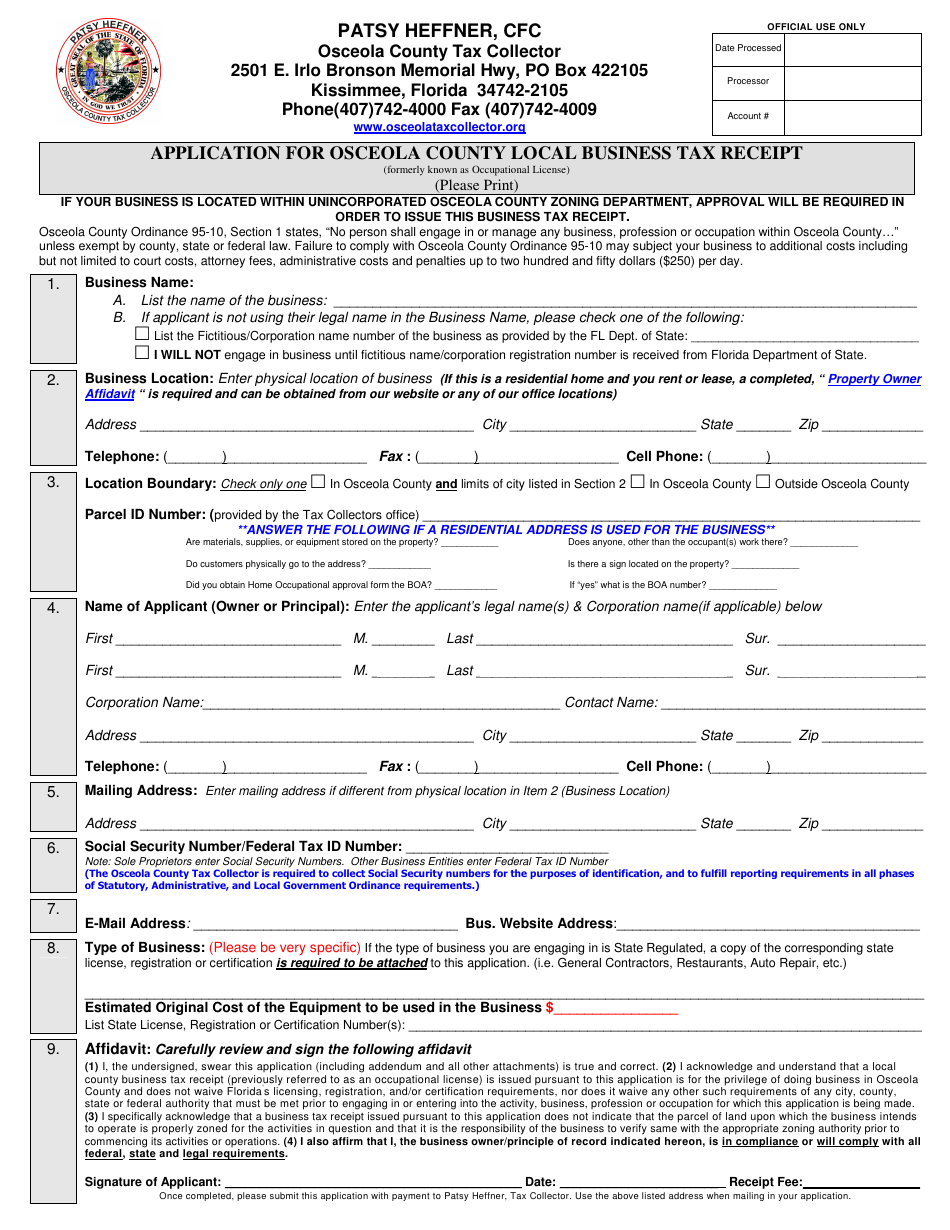

Osceola County Florida Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

Osceola County Tax Collector S Office Bruce Vickers

Osceola County Fl Property Tax Search And Records Propertyshark

Osceola County Property Appraiser How To Check Your Property S Value

Osceola County Florida Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

Osceola County Property Appraiser Katrina S Scarborough Cfa Ccf Mcf Facebook